By Palak Bhagasra, Researcher, Nitisara

In 2023, international shipping emitted over 1 billion metric tons of CO₂, making it one of the top contributors to global greenhouse gas emissions. Despite being one of the most energy-efficient modes of transport, the maritime sector’s environmental impact is no longer overlooked. With growing climate concerns, strict international regulations, and mounting market pressure, decarbonization in shipping has become a global mission. From transitioning to low-carbon fuels and investing in hybrid-electric technologies to overhauling ship design and greening port operations, the shipping industry is entering a new era. This blog explores how these initiatives are not only reducing emissions but actively reshaping the maritime sector’s identity, investments, and future.

Introduction

When the International Maritime Organization (IMO) updated its climate targets in July 2023, it did more than just set new goals — it set a new tone. The target? Achieve net-zero emissions from international shipping by or around 2050. For an industry long associated with heavy fuel oil and slow regulatory change, this marks a significant shift. Shipping is responsible for about 3% of global CO₂ emissions, more than Germany or Japan. As the backbone of global trade, the maritime sector cannot be left out of climate action. Today, decarbonization is no longer a niche topic for shipbuilders and regulators—it’s a core priority for port operators, fuel suppliers, logistics providers, and even consumers.

How Are Shipping Decarbonization Initiatives Driving the Maritime Sector?

Clean Fuels: Fueling a New Future

The move away from heavy fuel oil is one of the biggest transformations in the maritime sector today. Alternative fuels like Liquefied Natural Gas (LNG), methanol, ammonia, and biofuels are gaining ground. Though LNG still emits some CO₂, it cuts sulfur oxides by up to 90% and nitrogen oxides by 85%. in 2023, over 120 new vessels were ordered or retrofitted to run on these alternative fuels—showing a clear market shift. While no single fuel has emerged as the perfect solution, dual-fuel ships and regional fuel hubs are helping to test scalability and logistics. These transitions also create ripple effects—impacting port infrastructure, fuel supply chains, and even global shipping lanes.

Electric and Hybrid Ships: Powering Progress

Battery-powered ships are becoming more common, especially in regions like Scandinavia where short-distance travel is frequent. Norway, a leader in electric ferry technology, now has over 60 electric vessels in operation. hybrid propulsion systems combine electric power with traditional engines, improving fuel efficiency and reducing emissions during low-speed operations. While battery technology is still evolving for large cargo vessels, electrification is becoming viable for ferries, tugboats, and short-haul carriers—offering immediate carbon reduction in specific maritime segments.

Innovative Ship Design: Efficiency by Engineering

New-generation vessels feature aerodynamic hulls, energy-efficient engines, and technologies like air lubrication systems, which reduce water resistance. Wind-assisted propulsion systems, such as rotor sails or rigid sails, are being revived with modern technology. Route optimization algorithms, using weather and sea condition data, reduce travel time and unnecessary fuel consumption. these design innovations can reduce emissions by 10–20% per voyage, proving that not all sustainability solutions require a fuel change—some begin with smarter engineering.

Ports and Infrastructure: The Green Ecosystem

Green ports are central to decarbonization, offering shore power (cold ironing) so ships can switch off engines while docked. As of 2024, more than 40 major ports worldwide offer shore power, helping cut port-side emissions by up to 80%. investments in LNG and hydrogen bunkering are expanding, particularly in Asia and Northern Europe. Smart port systems are also integrating IoT sensors, automated cranes, and AI-based logistics to reduce waiting times and unnecessary fuel burn—making ports not just transfer points, but key enablers of a greener supply chain.

Regulations and Market Signals: The Push to Act

The EU’s Emissions Trading System (ETS) now includes shipping emissions, making carbon pollution a financial liability.the IMO’s Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI) are pushing operators to upgrade or phase out inefficient ships. Big companies like Amazon, IKEA, and Unilever are demanding zero-emission freight, adding market pressure alongside policy. Financial institutions are also adapting—green bonds and sustainability-linked loans are increasingly offered to shipping firms that meet emission-reduction benchmarks.

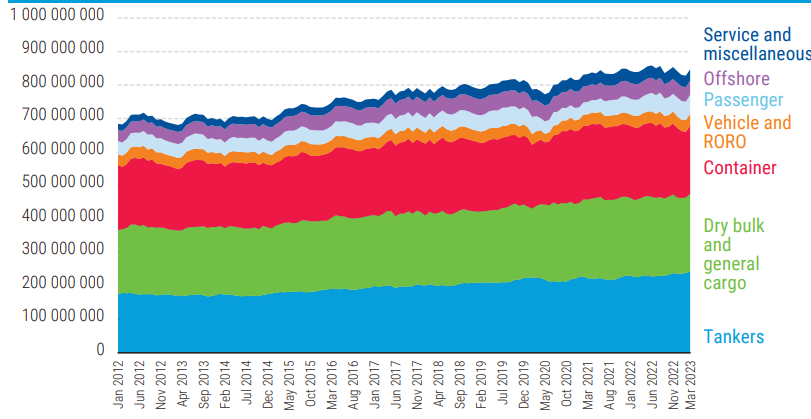

Source: UNCTAD, based on Ricardo and DNV (2022)

| Production Pathway | Input/Feedstock | Fuel Produced / Output |

|---|---|---|

| Electrolysis | Water and electricity | Hydrogen (electrolytic) |

| Natural gas extraction | Gas energy | Methane (natural gas) |

| Biogas production | Farm waste | Biogas |

| Biogas upgrading | Biogas | Methane (bio), CO₂ |

| Steam methane reforming | Methane and water | Syngas |

| Syngas pressure swing absorption | Syngas | Hydrogen (blue or bio), CO₂ |

| Nitrogen separation (PSA or cryo) | Air | Nitrogen, oxygen (trace gases) |

| Haber Bosch process | Nitrogen, hydrogen, heat energy | Ammonia |

| Carbon capture (industrial) | Fuel gas | CO₂ |

| Carbon capture (air) | Air and electricity | CO₂ |

| Sabatier process | CO₂ and hydrogen | Methane (synthetic), oxygen |

| Methane liquefaction | Methane (natural gas, bio) and electricity | LCH₄ (liquid methane) |

| Hydrogen liquefaction | Hydrogen and electricity | LH₂ (liquid hydrogen) |

| Ammonia liquefaction | Ammonia and electricity | LNH₃ (liquid ammonia) |

| Liquid bio-fuels | Wastes, oils, and crops | HVO, FAME (hydrotreated vegetable oil, fatty acid methyl esters) |

| Methanol synthesis | CO₂ and hydrogen | Methanol (synthetic) |

| Fischer–Tropsch | Hydrogen and CO₂ | Blue crude, e-diesel |

| Hydrogen ICE | Hydrogen | Water, nitrogen oxides |

| Hydrogen fuel cell | Hydrogen | Water |

| Methane ICE | Methane (+ diesel) | CO₂, NOₓ, CH₄ (methane) |

| Methanol ICE | Methanol (+ diesel) | CO₂, NOₓ |

| Ammonia ICE | Ammonia + diesel | CO₂, NOₓ, NH₄, N₂O (ammonium, nitrous oxide) |

Border Areas and Critical Concerns

- Developing countries may lack the resources to upgrade port infrastructure or adopt cleaner technologies—raising equity concerns.

- Fuel cost volatility and uncertain returns on green investments make shipowners hesitant to commit.

- Safety concerns arise with newer fuels like ammonia and hydrogen, which require specialized training and infrastructure.

- Retrofit vs. Replace? Older fleets must choose between expensive retrofitting or replacement—a major financial and operational decision.

Picture: Total carbon dioxide emissions by vessel types, tons, January 2012- March 2023, Author’s own

The Winds of Change Are Blowing :Charting a Sustainable Course Forward

The shipping industry stands at a pivotal juncture where environmental imperatives and economic realities converge to reshape the maritime landscape fundamentally. Decarbonization initiatives have emerged not merely as regulatory compliance measures, but as transformative forces driving unprecedented innovation, investment, and operational changes throughout the sector. The regulatory framework established by the International Maritime Organization, coupled with increasingly stringent regional policies, has created a clear trajectory toward carbon neutrality. These mandates have catalyzed a shift from voluntary sustainability measures to mandatory emission reductions, fundamentally altering how shipping companies approach vessel design, fuel procurement, and route optimization. The industry’s response has been remarkably swift, with major carriers investing billions in cleaner technologies and alternative fuel infrastructure.

Alternative fuel adoption represents perhaps the most visible transformation within the sector. The transition from traditional heavy fuel oil to ammonia, hydrogen, methanol, and other low-carbon alternatives has accelerated research and development efforts while creating new supply chain partnerships. This fuel diversification strategy not only addresses environmental concerns but also reduces the industry’s vulnerability to oil price volatility and supply disruptions. Technological innovation has become the cornerstone of maritime decarbonization efforts. From advanced hull designs that minimize drag to sophisticated energy management systems that optimize fuel consumption, shipping companies are leveraging cutting-edge solutions to reduce their carbon footprint. Digital technologies, including artificial intelligence and machine learning, are enabling more efficient route planning, predictive maintenance, and real-time performance monitoring, creating operational efficiencies that deliver both environmental and financial benefits.

The economic implications of decarbonization extend far beyond individual shipping companies. Green shipping corridors are emerging as new trade routes that prioritize environmental sustainability, potentially reshaping global commerce patterns. Port authorities are investing heavily in shore power infrastructure and renewable energy systems, transforming maritime hubs into sustainable logistics centers. These investments are creating new business opportunities while establishing competitive advantages for early adopters. Financial markets have responded positively to the sector’s sustainability transition, with green bonds and sustainable finance instruments becoming increasingly available for maritime projects. Environmental, social, and governance criteria are now central to investment decisions, rewarding companies that demonstrate genuine commitment to decarbonization while penalizing those that lag behind.

The collaborative nature of decarbonization efforts has fostered unprecedented cooperation between traditionally competitive stakeholders. Shipping lines, port operators, fuel suppliers, technology providers, and regulatory bodies are working together to address shared challenges and accelerate the transition to sustainable operations. This collaborative approach has proven essential given the complex, interconnected nature of maritime supply chains. However, significant challenges remain. The infrastructure required for alternative fuel production, distribution, and bunkering requires massive capital investment and international coordination. Technical hurdles related to energy density, storage, and safety protocols for new fuel types continue to pose implementation challenges. Additionally, the need for skilled personnel capable of operating and maintaining new technologies creates workforce development requirements that must be addressed systematically.

Looking ahead, the pace of change in maritime decarbonization will likely accelerate rather than diminish. Emerging technologies such as wind-assisted propulsion, advanced battery systems, and synthetic fuels will continue to expand the toolkit available to shipping companies. The development of carbon capture and utilization technologies specifically for maritime applications holds promise for further emission reductions. The success of shipping decarbonization initiatives will ultimately depend on sustained commitment from all stakeholders, continued technological innovation, and the development of supportive policy frameworks that balance environmental objectives with economic viability. As the maritime sector navigates this transition, companies that embrace decarbonization as a strategic opportunity rather than a regulatory burden will be best positioned to thrive in the evolving landscape.

The transformation of the shipping industry through decarbonization initiatives represents more than an environmental imperative—it embodies a fundamental reimagining of how goods move across the world’s oceans. As these initiatives continue to drive innovation, investment, and operational excellence, they are not only reducing the maritime sector’s environmental impact but also creating a more resilient, efficient, and sustainable foundation for global trade in the decades to come. The maritime industry is entering a phase of unprecedented transformation. Driven by policy, powered by technology, and pressured by both consumers and markets, decarbonization is no longer a side agenda—it’s at the helm. While the path is full of challenges, the direction is clear. Each innovation—whether it’s a battery-powered ferry, a ship running on green methanol, or a port plugged into renewable energy—represents a piece of a much larger movement: the transition to a cleaner, more responsible maritime future.

Stay informed through Nitisara Platform and Blogs and adapt to emerging trends are poised to thrive in the competitive global marketplace. – https://nitisara.org/category/blogs-updates. The views expressed do not represent the company’s position on the matter.

References

- International Maritime Organization (IMO). (2023). IMO Strategy on Reduction of GHG Emissions from Ships. Retrieved from https://www.imo.org

- UNCTAD. (2023). Review of Maritime Transport 2023. Retrieved from https://unctad.org/webflyer/review-maritime-transport-2023

- DNV. (2022). Maritime Forecast to 2050. Retrieved from https://www.dnv.com

- International Energy Agency (IEA). (2022). Energy Technology Perspectives: Shipping Sector Deep Dive. Retrieved from https://www.iea.org

- European Commission. (2023). EU Emissions Trading System: Shipping. Retrieved from https://climate.ec.europa.eu

- OECD International Transport Forum. (2021). Decarbonising Maritime Transport: Pathways to Zero-Carbon Shipping. Retrieved from https://www.itf-oecd.org

- World Bank. (2021). The Role of Green Shipping Corridors in Decarbonizing Maritime Trade. Retrieved from https://www.worldbank.org